Comprehensive Coverage: Protecting Your Vehicle Beyond Collisions

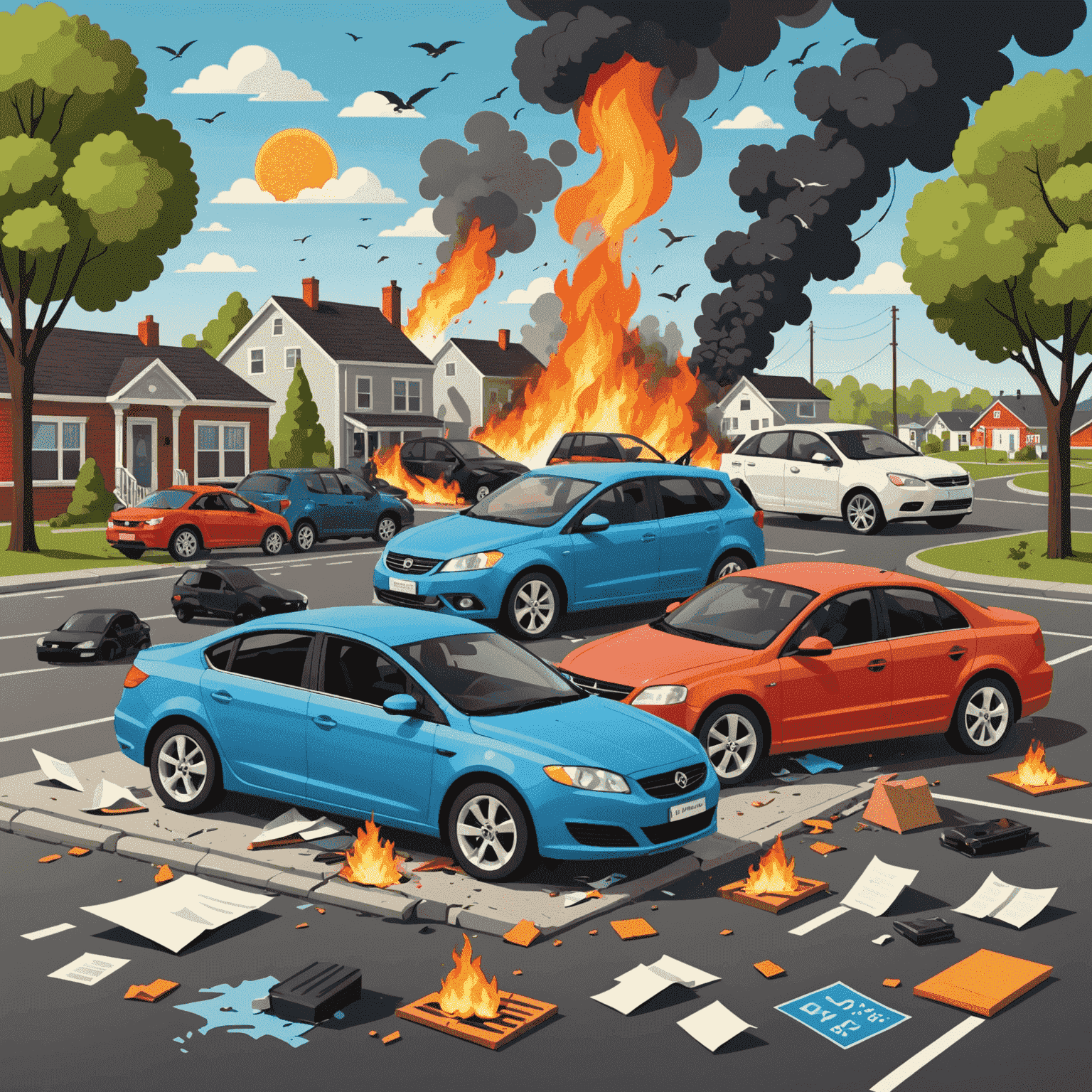

Comprehensive coverage is a crucial component of car insurance that safeguards your vehicle against non-collision related damages. Unlike collision coverage, which protects you in accidents involving other vehicles or objects, comprehensive coverage addresses a wide range of other potential risks.

What Does Comprehensive Coverage Include?

- Falling objects (e.g., trees, hail)

- Fire damage

- Flood damage

- Wind damage

- Theft

- Vandalism

Impact on Deductibles

When it comes to comprehensive coverage, understanding how deductibles work is essential for making informed decisions about your car insurance policy.

How Deductibles Work

A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. For comprehensive coverage, deductibles typically range from $100 to $1,000. The higher your deductible, the lower your premium, but the more you'll pay if you need to file a claim.

Deductible vs. Premium Trade-off

Key Considerations for Comprehensive Coverage

- Assess the value of your vehicle and your financial situation when choosing a deductible.

- Consider the likelihood of non-collision incidents in your area (e.g., frequent hailstorms, high theft rates).

- Remember that comprehensive coverage is often required if you're financing or leasing your vehicle.

- Review your policy regularly to ensure your coverage and deductible still meet your needs.